37+ recommended mortgage to income ratio

Web Key factors in calculating affordability are 1 your monthly income 2 cash reserves to cover your down payment and closing costs 3 your monthly expenses 4. In that case NerdWallet recommends.

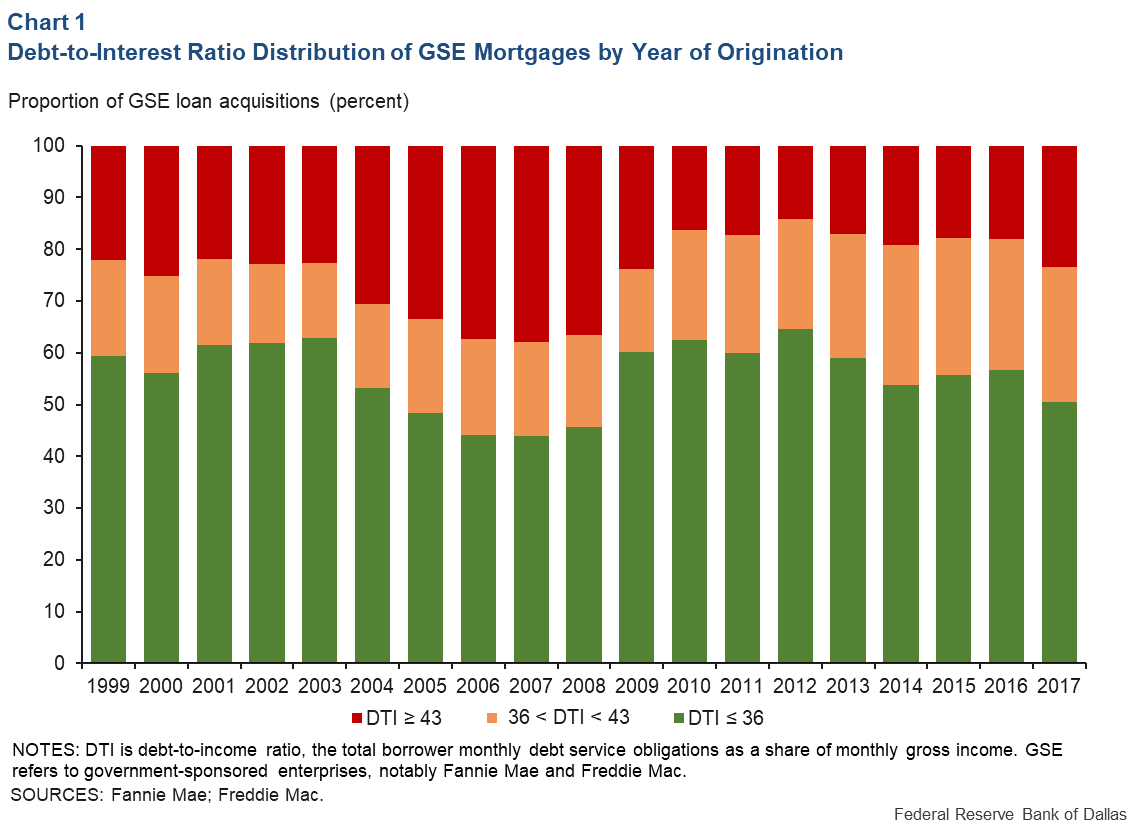

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

Rules differ by lender but most.

. Web Lets say your gross monthly income is 7000 and your debt is 3000. Debt can be harder to manage if your DTI ratio falls between. Get Preapproved Compare Loans Calculate Payments - All Online.

Web 7 hours agoDown 37 from its high. But with a bi-weekly. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43.

Web Generally a good debt-to-income ratiois around 36 or less and not higher than 43. 1 2 For example assume. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool. A front-end and back-end ratio. Keep your total debt payments at or below 40 of your pretax monthly income.

Web A debt-to-income ratio of 35 or less usually means you have manageable monthly debt payments. Best Mortgage Lenders. Ad When Banks Say No We Say Yes.

Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web To calculate your DTI add the expenses together to get 1700.

Web The DTI is calculated by adding your debt payment and dividing it by your gross monthly income. Web The 2836 is based on two calculations. An addition to the 28 rule is the 2836 rule or the back-end.

But it still anticipates posting an operating income margin in the range of 415 to 435 in the first quarter. Your DTI is 378. But each mortgage lender can set its own eligibility requirements and DTI.

Updated FHA Loan Requirements for 2023. Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income. Get Preapproved Compare Loans Calculate Payments - All Online.

Ad Compare Home Financing Options Online Get Quotes. Heres how lenders typically view DTI. Web For conventional loans the maximum can range from 43 percent to 45 percent and sometimes higher.

Payments of 2000 for a mortgage 500 for a car loan 300 for a student loan and. Get All The Info You Need To Choose a Mortgage Loan. Check Your Official Eligibility Today.

Ad Take the First Step Towards Your Dream Home See If You Qualify. Web How much income is needed for a 300K mortgage. Then divide 1700 by 4500 which equals 378.

For FHA loans its generally 43 percent but also can. If youd put 10 down on a 333333 home your mortgage would be about 300000. Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28.

Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. Choose The Loan That Suits You.

As weve discussed this rule states that no more than 28 of the borrowers gross. Ad Compare Home Financing Options Online Get Quotes. Web To calculate your front-end ratio add up your monthly housing expenses only divide that by your gross monthly income then multiply the result by 100.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property.

What Credit Score Is Needed To Buy A House

Debt To Income Ratios Home Tips For Women

Free 6 Payment Calculator Mortgage Samples In Pdf Excel

Mortgage Calculator Financial Philosophies

Infinite Banking Intro 21 08 31

Jpmc3q13exhibit991

Need A Mortgage Keep Debt Levels In Check The New York Times

How Much To Spend On A Mortgage Based On Salary Experian

Construction Loan What You Need To Know

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

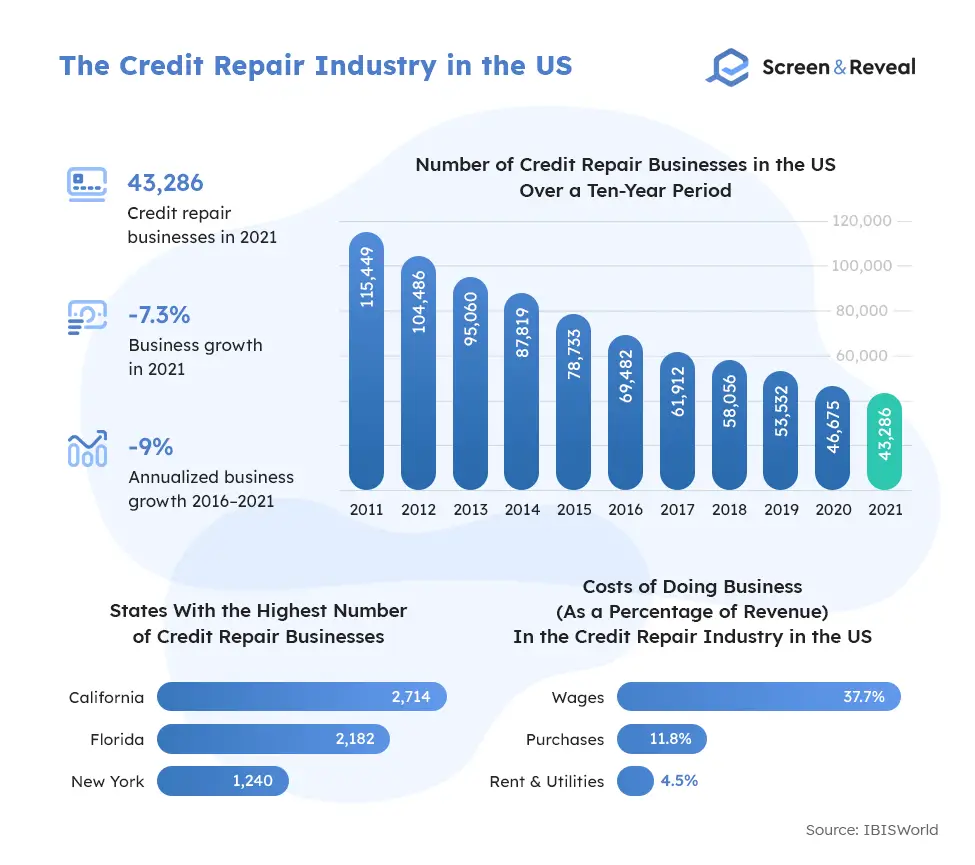

37 Credit Repair Statistics And Facts For 2022 Screen And Reveal

Housing Ratio Front End Ratio

Income To Mortgage Ratio What Should Yours Be Moneyunder30

The Percentage Of Income Rule For Mortgages Rocket Money

What Percentage Of Income Should Go To A Mortgage Bankrate

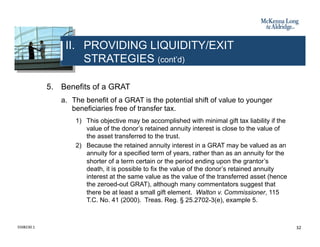

Business Succession Planning And Exit Strategies For The Closely Held

Do Loan To Value And Debt To Income Limits Work Evidence From Korea In Imf Working Papers Volume 2011 Issue 297 2011